Top 9 Solo-like Apps to Upgrade Your Music Experience in 2023

In the ever-evolving world of music technology, finding the perfect app to match your jamming preferences is essential for an exceptional musical experience. With 2023 offering a plethora of new and innovative apps, it’s time to explore your options and discover what alternatives exist beyond the realm of Solo. That’s why we’ve curated a list of the top 10 Solo-like apps to upgrade your music sessions with seamless functionality and immersive features. So, dive into our exclusive guide and unlock your creative potential with these ground-breaking replacements that will have you strumming, humming, and playing along in no time.

1.

Mint

4.8

Mint is a versatile personal finance app that effortlessly consolidates your financial life in one place, offering a comprehensive overview of your expenses, budget, and savings goals. With Mint, users can easily track spending habits, set personalized budgets, and receive real-time notifications for bill reminders, credit scores, and customized financial tips or insights. Its seamless integration with various financial institutions and user-friendly interface make it a favorite among budget-conscious individuals seeking a smart and efficient solution for managing their finances while gaining a clearer understanding of their financial health.

Pros

- Mint provides a comprehensive overview of your personal finances, including bank accounts, credit cards, investments, and bills.

- The budgeting tools allow you to set goals and track your spending in various categories, helping you identify areas where you can save money.

Cons

- Some users have reported issues with syncing their accounts or connecting to certain financial institutions.

- There are limited customization options for categories and budgeting, which may not be suitable for all users with unique financial situations.

Conclusion: Mint can be an effective tool for managing your personal finances, providing a clear picture of your financial standing and helping you plan for the future. However, it may not be the best fit for everyone, particularly those with more complex financial needs or who experience technical difficulties.

2.

YNAB

4.6

YNAB, short for You Need A Budget, is a popular budgeting app designed to help users gain control of their finances, eliminate debt, and build wealth through an easy-to-use interface and proven four-rule strategy. By focusing on prioritization, tracking expenses, and adjusting for financial changes, YNAB helps users attain financial freedom while offering comprehensive support through educational resources and a vibrant community. Experience the benefits of effective budgeting and money management with the YNAB app.

Pros

- YNAB has a user-friendly interface that makes budgeting and tracking expenses easy and intuitive.

- YNAB provides a helpful approach to budgeting that focuses on assigning every dollar a job, which can help users prioritize their spending and stay on track.

Cons

- YNAB requires a monthly or annual subscription fee, which may be a barrier to entry for some users.

- YNAB’s emphasis on assigning every dollar a job may not be the best fit for users who prefer a more flexible approach to budgeting.

Conclusion: Overall, YNAB is a solid budgeting app that offers helpful features and an effective approach to managing personal finances. However, the subscription fee and emphasis on rigid budgeting may not appeal to all users.

3.

Personal

4.5

Discover a seamless way to organize your life with the “Personal” app, an all-in-one solution designed to simplify your daily tasks. This intuitive app offers digital convenience with powerful features like calendar management, to-do lists, and note-taking, all while keeping your information private. Experience enhanced productivity and stay up-to-date with your appointments, tasks, and reminders, as “Personal” ensures that every aspect of your day is just a click away. Delve into a world of efficient time-management with the “Personal” app and unlock a smarter way to stay on top of your daily responsibilities. Experience seamless organization tailored just for you.

Pros

- The Personal app provides a convenient and centralized location for users to store and organize sensitive information, such as passwords, credit card details, and important documents.

- With the ability to sync data across devices and platforms, users can easily access their information whenever and wherever they need it.

Cons

- While the app offers a variety of security features, including encryption and biometric authentication, there is always a potential risk of data breaches or hacking.

- Some users may find the app too complex or overwhelming, particularly if they have a large amount of information to input and organize.

Conclusion: Overall, the Personal app can be a useful tool for managing personal information, but it is important to weigh the potential security risks against the convenience and accessibility it provides. Users should also take time to familiarize themselves with all of the app’s features and settings, in order to ensure they are using it to its full potential while minimizing any potential vulnerabilities.

4.

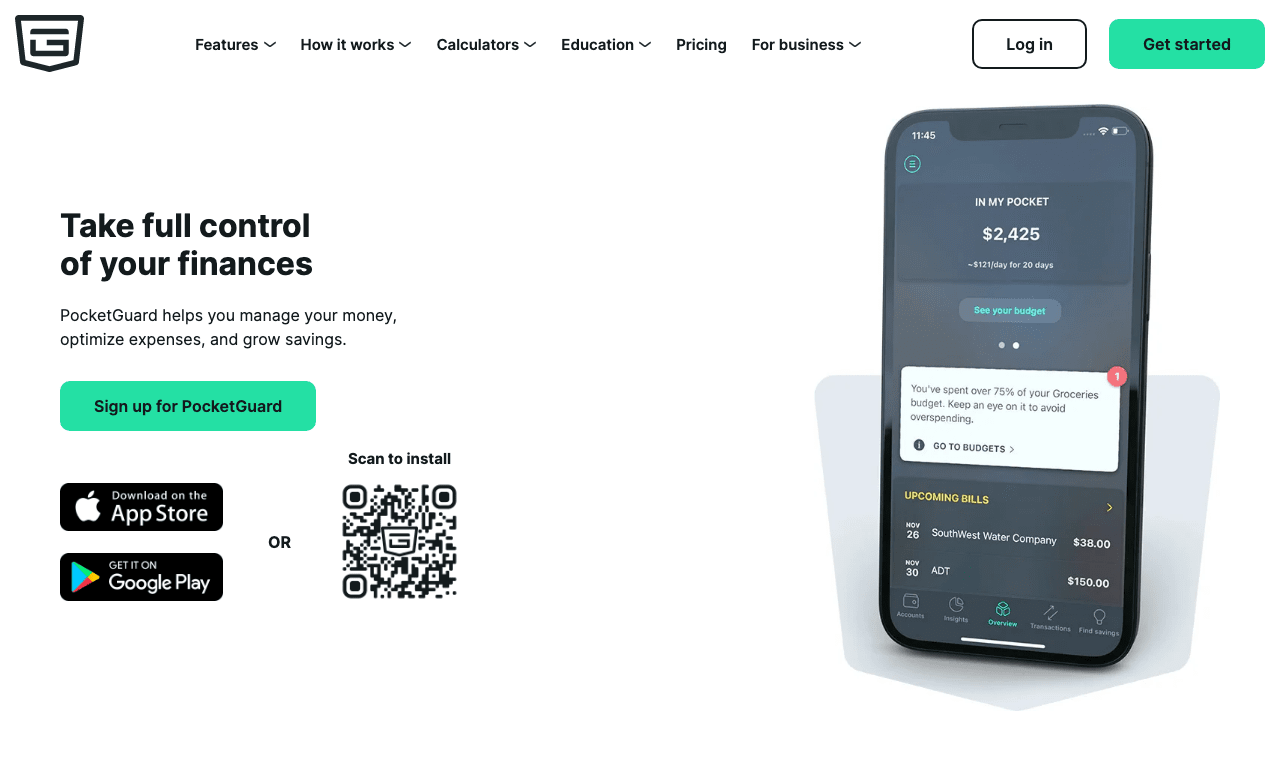

PocketGuard

4.4

PocketGuard is a feature-rich personal finance app designed to simplify money management and budgeting. With its intuitive interface and powerful tools, users can effortlessly track expenses, monitor account balances, and gain valuable insights into their spending habits. By categorizing transactions and analyzing spending patterns, PocketGuard empowers users to take control of their finances and make informed decisions for a better financial future. Discover the efficient way to stay on top of your finances with PocketGuard.

Pros

- Comprehensive overview of finances: PocketGuard aggregates all financial accounts in one place, giving users a clear picture of their spending, income, savings, and investments.

- User-friendly interface: The app is easy to navigate and understand, making it accessible to people at all levels of financial literacy.

Cons

- Limited budgeting tools: While PocketGuard helps users track their spending, it doesn’t offer as many budgeting features as other personal finance apps, such as the ability to set specific spending limits or adjust budget categories.

- Some features require a paid subscription: Certain features, such as customized savings goals and alerts for unusual spending, are only available with a PocketGuard Plus subscription.

Conclusion: Overall, PocketGuard is a solid choice for a personal finance app, particularly for those who need an all-in-one tool to manage their accounts and gain accurate insights into their financial health. However, users looking for advanced budgeting features may need to supplement with another app or service, and those who want access to all of PocketGuard’s features will need to pay for a subscription.

5.

Prism

4.3

Discover the power of Prism, a revolutionary app that streamlines financial management by offering an all-in-one platform for tracking bills, account balances, and paying expenses. Experience efficient budgeting and enhanced financial control, thanks to Prism’s advanced features, extensive support for various financial institutions, and intuitive interface. Join the growing community of satisfied users who enjoy complete visibility and management of their personal finances with the innovative Prism app.

Pros

- Easy to use interface that allows users to quickly find and filter news articles.

- Provides a range of reputable news sources from around the world, allowing users to get a more diverse range of perspectives on current events.

Cons

- Some users have raised concerns about the privacy implications of allowing an app to track your reading habits and political affiliations.

- Occasionally displays advertisements or sponsored content that can be confusing or misleading for some users.

Conclusion: Overall, Prism is a useful tool for individuals who want to stay up-to-date on current events and get a more diverse range of perspectives on the news. However, users should be aware of the privacy implications of using the app and approach the sponsored content with caution.

6.

Goodbudget

4.2

Goodbudget is a versatile personal finance app designed to help users effectively manage their money through the tried-and-true envelope budgeting system. Offering a seamless experience across multiple devices, Goodbudget makes tracking expenses, planning budgets, and monitoring savings simple and convenient. With its intuitive interface, insightful visual reports, and customizable categories, this app empowers users to take control of their finances and achieve financial peace of mind. Whether you’re new to budgeting or a seasoned pro, Goodbudget provides valuable tools and resources to guide you on your journey to financial well-being.

Pros

- Goodbudget offers a simple and intuitive budgeting system that is easy to use and understand, making it a great option for beginners or those new to budgeting.

- The app offers synchronization across multiple devices and platforms, allowing users to easily access and modify their budget from their smartphone, tablet, or computer.

Cons

- Goodbudget does not offer as many advanced features as some other budgeting apps, such as the ability to link bank accounts and automatically categorize transactions.

- Some users have reported difficulty with the app syncing their data properly, leading to discrepancies between devices and the loss of important data.

Conclusion: Goodbudget is a solid budgeting app for those who are new to budgeting or prefer a simpler system. However, its lack of advanced features may not be sufficient for those with more complex financial needs. While the app’s synchronization capabilities are a plus, inconsistencies in data syncing can lead to frustration and lost progress.

7.

Clarity

4.0

Clarity is a cutting-edge app designed to streamline communication and enhance productivity in professional environments. With its intuitive interface and advanced features, Clarity offers users a seamless experience, effortlessly connecting team members for efficient collaboration. Experience unparalleled communication clarity and revolutionize the way you work with this powerful, user-friendly tool.

Pros

- Clarity helps users track their screen time and app usage, which can be helpful for individuals who want to be more mindful of their technology habits.

- The application allows users to set goals for themselves, such as limiting social media usage or creating more breaks throughout the day.

Cons

- Clarity requires users to grant it access to their phone and activity data, which may be a concern for individuals who prioritize privacy.

- The application may not be helpful for individuals who struggle with self-discipline or who require a different method of breaking technology addiction.

Conclusion: Overall, Clarity can be a helpful tool for individuals who want to be more aware of their technology usage and create goals for themselves. However, users should weigh the pros and cons of the application before granting it access to their personal data.

8.

Simplifi

3.9

Simplifi is a cutting-edge app designed to streamline your financial management, providing a comprehensive overview of your income, expenses, and savings. With its personalized budget tracking capabilities and intuitive interface, Simplifi empowers users to make informed financial decisions, improve their financial well-being, and achieve their long-term financial goals. Utilizing advanced security measures and real-time synchronization, Simplifi ensures that your financial data is always up-to-date and secure. Discover the future of personal finance management with the Simplifi app today.

Pros

- Simplifi provides a comprehensive view of your finances in one place, including budgets and account balances.

- The app offers insights and customized suggestions to help users improve their financial health.

Cons

- Simplifi is only available in the United States, so international users cannot take advantage of its features.

- Some users may find the subscription fee to be expensive, especially compared to other budgeting apps that are available for free.

Conclusion: Overall, Simplifi offers a valuable service for those who are looking to streamline their finances and get a better handle on their budget. However, it is important to consider the cost of the app and whether it is worth the investment for your particular financial situation.

9.

Money

3.8

Money is a top-rated personal finance app designed to simplify money management and budgeting. It offers users an intuitive platform to track their expenses, set financial goals, and monitor their savings. The app seamlessly syncs with multiple accounts, providing a comprehensive view of financial activities and progress. Additionally, Money features insightful reports and custom alerts to keep users informed about their financial health. Experience stress-free budgeting and achieve financial success with the Money app.

Pros

- Provides a clear overview of all personal finances in one place

- Offers various budgeting and tracking tools to help users stay on top of their spending

Cons

- Limited ability to customize categories and budgeting options

- Some users have reported experiencing glitches and technical difficulties with the app

Conclusion: Overall, the Money app is a useful tool for managing personal finances. While there are some limitations to its customization options and occasional technical issues, its clear interface and helpful budgeting tools make it worth trying out.

Frequently Asked Questions

What are the best Solo-like apps for personal finance management in 2023?

The most popular Solo-like apps for personal finance management in 2023 include Mint, YNAB, Personal, PocketGuard, Prism, Goodbudget, Honeyfi, Clarity, Simplifi, and Money.

Are there any free alternatives to Solo for budgeting and personal finance management?

Yes, several free alternatives to Solo are available for budgeting and personal finance management, such as Mint, Prism, and Goodbudget. However, some apps may offer limited features in their free versions and require a subscription for full access.

How do I choose the right Solo-like app for my financial needs?

When choosing a Solo-like app, consider factors like your preferred budgeting method, the types of financial accounts you have, and the app’s interface and features. Read reviews from other users and try out the app to see if it meets your requirements.

Are Solo-like apps safe to use for managing finances?

While no app can guarantee complete security, most Solo-like apps employ advanced security measures, such as data encryption and biometric authentication, to protect user’s information. Always research the security features and privacy policies of an app before using it for managing personal finances.

Can Solo-like apps help improve my financial well-being?

Yes, Solo-like apps can help improve your financial well-being by providing insights into your spending patterns, offering personalized budgeting tools, and helping you set and achieve financial goals.

Are there any apps specifically designed for couples to manage their finances together?

Yes, Honeyfi is an app specifically designed for couples to manage their finances collaboratively. It allows users to track expenses, set budgets, and manage account balances in a single platform.

Do all Solo-like apps require a monthly or annual subscription fee?

No, not all Solo-like apps require a subscription fee. Some apps, like Mint and Prism, offer free services with limited features, while others, like YNAB and Simplifi, require a subscription for full access.

Can I sync my financial data across multiple devices with Solo-like apps?

Most Solo-like apps allow users to sync their financial data across multiple devices, including smartphones, tablets, and computers. This ensures that users have access to their financial information whenever they need it.

Do Solo-like apps support international users and multiple currencies?

Some Solo-like apps, like Goodbudget and Money, support international users and multiple currencies. However, some apps, like Simplifi, are only available for users in the United States.

What are the privacy implications of using Solo-like apps?

When using Solo-like apps for managing personal finances, it’s essential to be aware of the privacy implications associated with sharing your financial information with an app. Review the app’s privacy policies and permissions before use, and take measures to secure your data, like using strong, unique passwords and enabling two-factor authentication when possible.

What features does the Solo app offer?

The Solo app is packed with features designed to assist users with their time management, self-organization, and productivity. These include a task manager for planning and tracking tasks, a notes section for jotting down important information, and a calendar to keep up with appointments and critical dates. The app also enables synchronization with Google Calendar for seamless integration of personal and professional schedules. Its interface is user friendly and intuitive, making it easy for both first-time and veteran users.

How do I create an account on the Solo app?

To sign up for the Solo app, you need to download the app from either the App Store for iOS or the Google Play store for Android. Once downloaded, open the app and click on the ‘Sign Up’ button on the welcome screen. Then, simply follow the prompts to enter your details and create your account.

Is the Solo app free to use?

The Solo app offers both free and premium versions. The free version provides access to many of its excellent organizing features but has some limitations. However, users can upgrade to the premium version for a subscription fee to unlock more features, such as unlimited tasks, reminders, and advanced synchronization capabilities.

How can I reset my Solo app password if I forgot it?

If you forget your Solo app password, you can reset it by clicking the Forgot Password? link on the login screen. Then, enter the email address associated with your account. You will receive an email with instructions on how to reset your password. Be sure to check your spam or junk mail folder if you don’t see the email in your inbox.

Can I synchronize Solo app with other applications?

Yes, Solo provides sync capabilities with Google Calendar, allowing you to integrate your personal and professional schedules seamlessly. It is always advisable to check the settings of the target app for any required permissions or specific settings for the successful synchronization.

How do I delete my account from the Solo app?

To delete your account from the Solo app, navigate to the settings menu within the app, and look for the ‘Delete Account’ option. Clicking this button will permanently delete your account and all associated data. Make sure this is what you want to do as this action cannot be undone.

How can I change the language in the Solo app?

You can change the language of your Solo app by heading to the settings menu. From there, look for the language option and select your preferred language from the dropdown list provided.

Can I share my Solo app tasks with others?

Yes, Solo app allows you to share your tasks with others. You can do this by clicking on the specific task and using the share icon at the top right corner of the task detail screen. Then, choose the app through which you want to share the task.

Is there a desktop version for Solo app?

Unfortunately, as of now, Solo does not have a distinct desktop version. The app is exclusively designed for use on mobile devices, with both iOS and Android platforms supported. Despite this, Solo is known for continuously improving and expanding their services and may consider a desktop version in the future.

How can I contact Solo app customer service?

For any queries or issues, you can tap on the settings icon in the Solo app and look for the ‘Contact Us’ option. Here, you can send a detailed message to the customer service team, and they’ll get back to you as soon as possible.

ping.fm

ping.fm