Top 4 Square Alternatives: Best Payment Apps for Businesses in 2023

In today’s fast-paced digital world, having the right payment processing app can make all the difference for your business. Square has long been a top choice for small businesses, but with so many alternatives available, it’s worth exploring other options to find the perfect fit for your needs. In this article, we’ll cover the top 10 Square alternatives for 2023, offering you a comprehensive comparison of the best payment apps on the market. Discover the features, pricing, and unique selling points of each app, making it easier for you to choose the ideal solution to streamline your transactions and boost your bottom line. So, let’s dive in and discover the top contenders in the world of payment processing apps!

1.

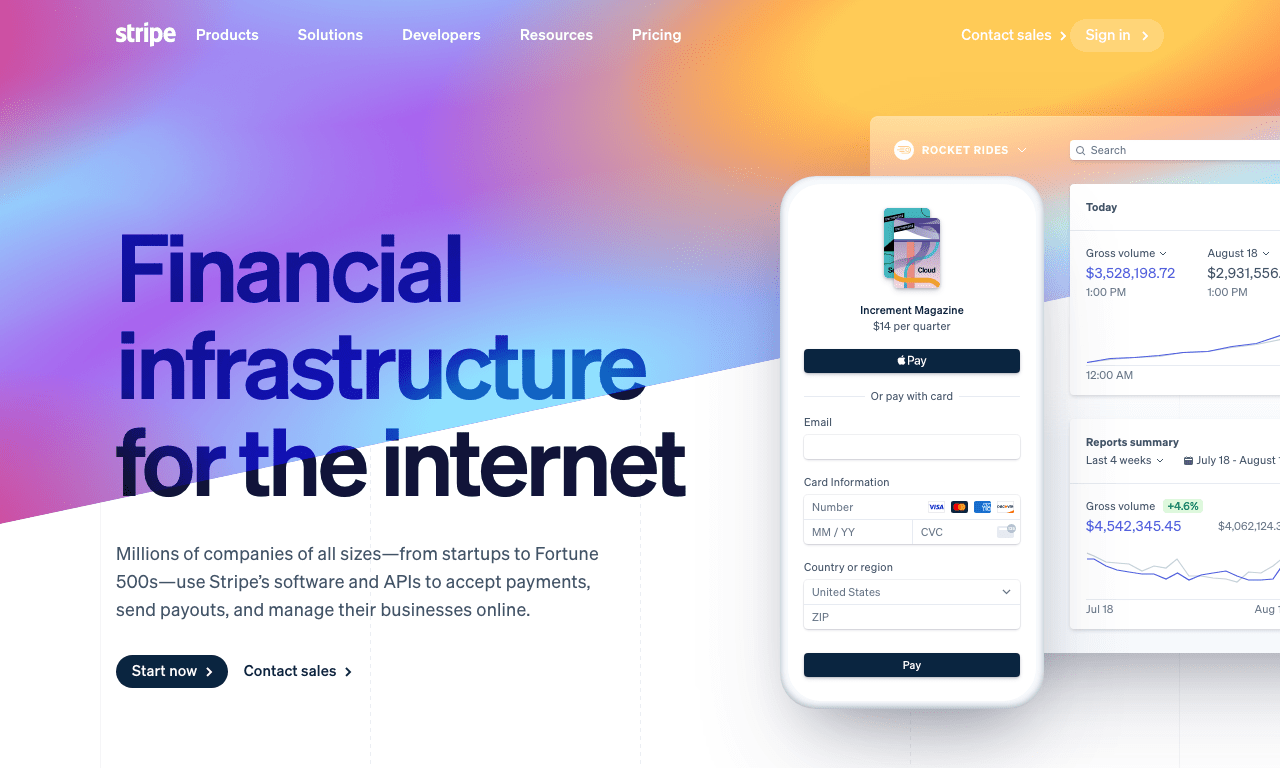

Stripe

4.7

Stripe is a leading payment processing app designed to streamline online transactions for businesses of all sizes. This innovative solution offers a range of features such as customizable payment flows, seamless integration, and advanced security measures, making it an ideal choice for e-commerce platforms and entrepreneurs seeking efficient payment management. By providing an easy-to-use interface and consistent customer experience, Stripe empowers businesses to drive growth and adapt to the ever-changing digital landscape. Experience the difference with Stripe – the ultimate app for secure and seamless online payment processing.

Pros

- Stripe has a user-friendly interface, making it easy for businesses to set up and start using.

- Stripe offers a variety of payment options, including credit/debit cards and digital wallets like Apple Pay and Google Pay.

Cons

- Stripe charges a higher fee for international transactions compared to domestic transactions.

- Customer support for Stripe can be slow or unresponsive at times, which can be frustrating for businesses in need of immediate assistance.

Conclusion: Stripe is a widely used and respected payment processor that offers a variety of benefits, such as a user-friendly interface and a variety of payment options. However, businesses should be aware of the potential cons, such as higher fees for international transactions and slower customer support. Ultimately, the decision to use Stripe will depend on each business’s individual needs and priorities.

2.

SumUp

4.5

SumUp is a cutting-edge mobile app that elevates your payment experience by simplifying and streamlining the process for businesses and customers alike. This innovative solution transforms your smartphone or tablet into a versatile payment terminal, allowing swift and secure transactions with just a tap. Its user-friendly interface and robust features cater to a wide range of industries, offering a seamless and cost-effective way to accept credit card payments on-the-go. Harness the power of SumUp’s technology to enhance your business operations and stay ahead in the digital age.

Pros

- SumUp is very easy to use and it takes only a few minutes to set up an account and start accepting payments.

- The transaction fees are very competitive and are among the lowest in the industry, making it a great choice for small business owners who are looking to save on costs.

Cons

- SumUp doesn’t offer as many features and customization options as some of its competitors, which may be a drawback for businesses with more complex needs.

- The customer support can be slow to respond at times, and there have been some complaints about the quality of support provided.

Conclusion: Overall, SumUp is a solid choice for small business owners who are looking for a simple and affordable way to accept card payments. While it may not offer all the bells and whistles of some other options on the market, it’s a reliable and user-friendly option that should suit the needs of most small business owners.

3.

FreeAgent

4.1

FreeAgent is a comprehensive, cloud-based accounting software designed to simplify financial management for small businesses and freelancers. With its user-friendly interface and robust features such as invoicing, expense tracking, project management, and customizable reporting, users can effortlessly manage their finances and make informed business decisions. Experience seamless integration with popular platforms, bank feeds, and reliable security with FreeAgent – the ultimate accounting solution for effortless financial management.

Pros

- Offers a range of features for financial management, including invoicing, expense tracking, and bank account connection.

- Provides real-time data and reporting, aiding in business decision making.

Cons

- Some users may find the interface overwhelming or confusing at first.

- While the software is fairly priced, it may still be more expensive than some other basic accounting software options.

Conclusion: FreeAgent is a strong choice for individuals or small businesses that require more advanced financial management tools beyond basic accounting software. While there are some initial challenges to learning and navigating the software, the benefits of increased data insight and real-time reporting make it a worthwhile investment for many.

4.

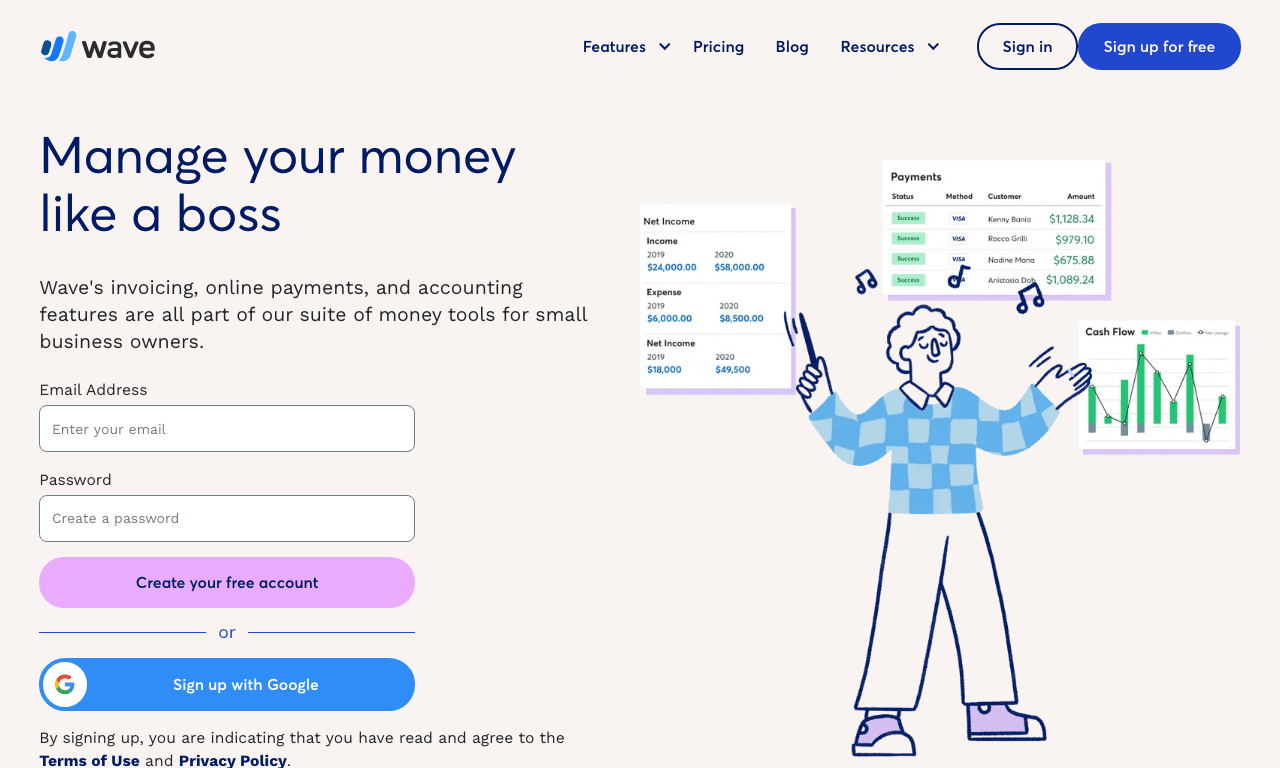

Wave

3.9

Wave is a cutting-edge mobile app that seamlessly combines the convenience of instant communication with the power of innovative location sharing technology. This unique app allows users to effortlessly connect with friends, family, and acquaintances, providing an enhanced navigational experience. Wave encourages users to explore their surroundings, discover new meeting spots, and coordinate gatherings with ease – all while ensuring user privacy and data protection. Experience true spatial connectivity with the unparalleled features of Wave.

Pros

- Ability to collaborate with others in real-time

- A wide range of supported file types, including audio, video, and documents

Cons

- Limited customization and formatting options

- Must have an internet connection to use the app

Conclusion: Overall, Wave is a useful application for those who need to collaborate on projects with others in real-time or work with various file types. However, it may not be the best option for those who require extensive customization or frequently work offline.

Frequently Asked Questions

What is the best alternative to Square for small businesses in 2023?

The best alternative for your small business will ultimately depend on your unique requirements. That being said, popular options include PayPal, Stripe, Shopify, and SumUp. Consider comparing the features, pricing, and customer support of each platform before making a decision.

Are Square alternatives generally more affordable for businesses?

Some Square alternatives offer lower transaction fees, while others may have higher fees for certain services. It’s crucial to carefully analyze the pricing structure of each alternative to determine which option best suits your budget and business needs.

Which payment processing app offers the best customer support?

While customer support experiences vary, PayPal and Stripe are generally known for providing reliable and efficient customer support. However, it’s important to consider user reviews and conduct research to determine which platform offers the best support for your specific business needs.

Can I switch between different payment processing apps easily?

In most cases, switching between payment processing apps should be relatively seamless, especially if you’re using popular platforms that integrate well with your existing business software. However, it’s important to be prepared for potential hiccups during the transition process, such as technical issues and compatibility concerns.

How do I determine if a payment app is secure for my business?

Ensure the payment app follows industry-standard security practices, including encryption, tokenization, and PCI compliance. You may also want to consider the app’s reputation in the market and consult user reviews to gather insight into the platform’s security features.

Do all payment apps support multicurrency payments?

Not all payment apps support multicurrency payments, but popular platforms like PayPal and Stripe do offer this functionality. It’s important to verify that your chosen provider supports the currencies and payment methods relevant to your target market.

Are Square alternatives only for e-commerce businesses?

No, many Square alternatives cater to a variety of businesses, including brick-and-mortar stores and service-based industries. Platforms like SumUp and iZettle, for example, provide mobile card readers for in-person transactions.

Can I use multiple payment processing apps simultaneously for my business?

In some cases, businesses might choose to use multiple payment processing apps to cater to different customer preferences or to process specific types of transactions. However, using multiple apps can also introduce complexity and additional fees, so carefully consider your needs before committing to multiple platforms.

Which payment app offers the most integrations with other business tools?

Platforms such as Shopify and Zoho are known for offering a wide range of integrations with third-party business applications. However, it’s crucial to investigate each platform’s compatibility with your existing business tools, as integrations vary depending on the specific app in question.

How do I choose the right payment processing app for my business?

To determine the ideal payment processing app for your business, consider factors such as pricing, fees, features, customer support, security, compatibility, and integrations. Additionally, gather insight from user reviews and conduct thorough research on each platform’s capabilities, limitations, and ideal use cases.

What is the Square app and what are its main features?

The Square app is a transaction processing application that allows businesses to accept payments from customers anywhere, anytime. It includes a portable card reader which connects to a smartphone or tablet, enabling card payments to be taken on the go. Its primary features include Point of Sale (POS) system, invoicing, sales reports, inventory management, digital receipts, and more. The app also utilizes data security to ensure all transactions are safe and secure. Square offers a diverse set of solutions for both small businesses and large enterprises.

How does the Square credit card reader work?

The Square card reader is a device that connects to your smartphone or tablet via the headphone jack, enabling you to take credit card payments. When a card is swiped through the device, it reads the details and processes the transaction through the Square app. All card details are encrypted for security, with transaction details visible on the Square dashboard for easy tracking and management.

What are the transaction fees associated with Square?

Square charges a flat rate of 2.6% + 10¢ for all swiped transactions. For manual entries or online sales, the charge is higher, at 3.5% + 15¢ per transaction. There is no charge for using the Square mobile app or service beyond these transaction fees, making it affordable for businesses of all sizes.

How can I sign up for Square?

To sign up for Square, visit the Square website, click on ‘Get Started’, and follow the prompts. You’ll need to provide some basic details about your business and personal contact information, then set up your account. Once your account is set up, you can start taking payments by attaching the Square reader to your smartphone or tablet.

Does Square offer any customer support?

Yes, Square offers comprehensive customer support through various channels. They have a dedicated support center on their website which offers help articles on a wide range of topics. In addition to this, they provide phone and email support for resolving specific queries or issues.

Can Square integrate with other applications?

Yes, Square offers the ability to integrate with various other applications to enhance its functionality. Both e-commerce platforms like Shopify and accounting apps such as QuickBooks and Xero can be connected to Square to streamline managing sales, inventory, and finances.

Are transactions secured with Square?

Yes, Square uses data encryption and other advanced security measures to ensure all credit card transactions are secure. The app is compliant with PCI-DSS standards and includes features such as fraud detection and dispute management to provide a safe and reliable platform for businesses and their customers.

Can Square be used for online sales?

Yes, Square allows businesses to set up an online storefront or integrate with their existing website using Square Online. This enables businesses to sell products and services online and accept payments securely via the Square system.

Does Square offer any addition apart from the payment processing?

Beyond payment processing, Square offers a suite of business tools to assist with operations management. These include invoicing and billing, inventory tracking, sales and revenue reporting, marketing services, payroll management, and much more. This makes Square a comprehensive solution for small to medium-sized businesses.

Do I need to commit to a long-term contract with Square?

No, there is no requirement for long-term contracts with Square. Users can start or stop using the services whenever they please without incurring any cancellation fees or long-term commitments. This provides businesses with the flexibility to adapt their payment solutions as their needs change.

ping.fm

ping.fm